The world has awakened to the power of Deepseek, the rival to OpenAI's Model o1 that has tech stocks reeling. I played around with Deepseek for a couple of hours yesterday, and I talked with a number of friends who are already using it to do some pretty advanced coding and problem solving.

Early this morning, Apollo's Torsten Slok shared a new report from the Bank of Canada. He highlighted a simulation the Bank ran to assess the potential impact on Canada if the US imposes a 25% tariffs on all exports into the United States. The results show that Canadian GDP would decline by a whopping 6%.

I wondered whether Deepseek would come up with a similar estimate. So I asked it.

Notice that I didn't just ask it to estimate the impact of a 25% tariff on Canadian GDP. I asked it to create a model and use it to simulate the effects of the tariff. Here's what it did.

First, it reasoned through the problem.

Okay, so I need to figure out how to model and simulate the impact on Canadian GDP if the US imposes a 25% tariff on all Canadian exports. Let me start by breaking this down.

First, I know that Canada exports a lot to the US. What's the percentage? I think it's around 75% of Canada's exports go to the US. So, if the US puts tariffs on those exports, that could make Canadian goods more expensive in the US, leading to lower demand. That would reduce Canada's export volume, right? Which in turn would affect GDP since exports are a component of GDP (GDP = C + I + G + (X - M)). So lower X (exports) would mean lower GDP, all else equal.

But how much would exports decrease? That depends on the elasticity of demand. If the demand for Canadian goods is elastic, a price increase due to tariffs would lead to a larger drop in quantity demanded. If it's inelastic, maybe less of a drop. But how do I estimate that? Maybe look at historical data or similar scenarios. For example, when the US imposed tariffs on steel and aluminum, what happened to Canadian exports? Though that was a specific case, maybe different from a blanket 25% tariff.

Also, there might be retaliation. Canada might impose tariffs on US goods, which could affect imports and maybe protect some domestic industries, but could also lead to higher prices for consumers and businesses. But the question is about the impact on Canadian GDP, so the retaliation might have secondary effects. Hmm, but maybe the model should focus on the direct effects first, then consider possible indirect effects.

Next, the model structure. I think a Keynesian approach might work here, focusing on the reduction in net exports. So, the initial shock is a decrease in exports. The multiplier effect would then determine how much GDP decreases overall. But I need to estimate the initial decrease in exports, then apply the multiplier.

To get the initial decrease, I need to estimate the price elasticity of demand for Canadian exports to the US. Suppose the tariff is 25%, so the price of Canadian goods in the US increases by 25%. If demand is elastic, say elasticity is -1.5, then a 25% price increase would lead to a 37.5% decrease in quantity demanded (1.5 * 25%). But if elasticity is -0.5, then only a 12.5% decrease. But what's a realistic elasticity for Canadian exports? Maybe aggregate exports are somewhat inelastic in the short run if there are no substitutes, but over time, more elastic. But since we're simulating the immediate impact, maybe use a moderate elasticity.

Alternatively, maybe use historical data. For instance, in 2018, the US imposed 25% tariffs on steel and 10% on aluminum from Canada. How did that affect exports? I recall that Canadian steel exports to the US dropped, but I don't have exact numbers. Maybe this is too specific. Alternatively, look at studies on trade elasticity. Some sources suggest that the average elasticity of exports with respect to tariffs is around -2 to -3. Wait, but that might be in the long run. Short-run elasticities are lower, maybe around -1.

Assuming a tariff of 25%, and an elasticity of -1, the export volume would decrease by 25%. But wait, elasticity is % change in quantity over % change in price. So if the tariff causes a 25% increase in price (assuming the entire tariff is passed on to the consumer), then the % change in quantity would be elasticity * % change in price. So if elasticity is -1, a 25% price increase leads to a 25% decrease in quantity. But in reality, the pass-through might not be 100%. Maybe Canadian firms absorb some of the tariff by lowering their prices, so the effective price increase in the US market is less than 25%, leading to a smaller quantity reduction. This complicates things. Maybe assume a 50% pass-through, so the price increases by 12.5%, leading to a 12.5% decrease in quantity if elasticity is -1. But I need to make some assumption here.

Alternatively, use a more empirical approach. Suppose Canada's exports to the US are about $400 billion annually (I think it's around there). A 25% tariff would make those exports more expensive. If the demand elasticity is -1, then a 25% price increase leads to 25% lower quantity, so exports drop by 25% in volume, but since prices are higher, the value might not drop as much. Wait, but tariffs are paid by the importing country, so the export value (FOB) would be the Canadian price, while the US price is Canadian price plus tariff. So if Canadian firms keep their prices the same, the US price increases by 25%, leading to lower quantity demanded. So the export value (in Canadian terms) would decrease by the percentage decrease in quantity. So if quantity drops by 25%, export revenue drops by 25%.

Assuming Canada's exports to the US are $400 billion, a 25% decrease would be $100 billion loss in exports. Then, the impact on GDP is the change in net exports (X - M). But imports might also change if Canada retaliates, but let's assume initially no change in imports. So the direct hit is $100 billion. But GDP is in annual terms, so if the tariff is imposed for a year, the annual GDP would decrease by $100 billion times the multiplier. The multiplier effect depends on the marginal propensity to consume and the tax rate etc. A simple multiplier might be around 1.5. So $100 billion * 1.5 = $150 billion decrease in GDP. Canada's GDP is about $2 trillion USD, so $150 billion would be a 7.5% decrease, which seems really high. That can't be right. Maybe my assumptions are off.

Wait, Canada's GDP is approximately $2.1 trillion CAD (as of recent data), and exports to the US are about 20% of GDP. So if exports are $400 billion CAD, and GDP is $2.1 trillion, that's roughly 19% of GDP. So a 25% decrease in exports would be 0.25 * $400 billion = $100 billion, which is about 4.76% of GDP. Then applying a multiplier, say 1.5, that would lead to a 7.14% decrease in GDP. But that still seems high. Historical shocks are rarely that large. Maybe the elasticity assumption is too high. If elasticity is -0.5, then a 25% price increase leads to 12.5% decrease in quantity, so $50 billion loss, which is 2.38% of GDP, times multiplier 1.5 = 3.57% GDP decrease. That's still significant but more plausible.

Alternatively, maybe only part of the exports are affected. Wait, the question says 25% tariffs on all exports from Canada to the US. So all sectors. So the entire $400 billion (assuming that's the total) is subject to 25% tariff. So the calculation above applies. But in reality, not all exports may have the same elasticity. For example, energy products might be more inelastic, while manufactured goods more elastic. So the aggregate elasticity might be an average. Maybe -0.7. So 25% price increase leads to 17.5% decrease in quantity. So 0.175 * 400 = $70 billion. 70/2100 = 3.33% of GDP. Multiplier effect: 3.33% * 1.5 = 5% GDP decrease. Still substantial.

But perhaps the multiplier is lower in an open economy because part of the demand leaks into imports. The multiplier formula for an open economy is 1/(1 - MPC + MPI), where MPI is marginal propensity to import. If MPC is 0.6 and MPI is 0.3, then multiplier is 1/(1 - 0.6 + 0.3) = 1/0.7 ≈ 1.43. So less than 1.5. So using 1.43, 3.33% * 1.43 ≈ 4.76% GDP decrease.

But these numbers are very rough. To create a model, I need to structure it with equations.

Let me outline the model steps:

1. Determine the initial value of Canadian exports to the US.

2. Estimate the price elasticity of demand for Canadian exports in the US.

3. Calculate the percentage change in export quantity due to the tariff.

4. Convert the quantity change into a value change (export revenue).

5. Compute the direct effect on GDP (ΔX).

6. Apply the multiplier effect to account for the indirect effects on consumption, investment, etc.

7. Consider any secondary effects, such as retaliatory tariffs, exchange rate adjustments, or shifts in trade patterns.

For step 1, let's say Canadian exports to the US are $400 billion CAD annually.

Step 2: Assume an elasticity (ε) of -1.2 (a mid-range estimate).

Step 3: Tariff (t) = 25%, leading to a price increase in the US market. If pass-through is 100%, the price increases by 25%, so %ΔQ = ε * %ΔP = -1.2 * 25% = -30% change in quantity.

Step 4: The change in export value (assuming Canadian exporters don't lower their prices) would be the percentage change in quantity times the original value. So -30% * $400 billion = -$120 billion.

Step 5: Direct effect on GDP is -$120 billion. As a percentage of GDP ($2.1 trillion), that's -5.7%.

Step 6: Apply the multiplier. If the multiplier is 1.4, total GDP impact is -5.7% * 1.4 ≈ -8%.

But that's a huge drop. Maybe the elasticity is lower. If ε = -0.8, then %ΔQ = -20%, leading to -$80 billion, which is -3.8% of GDP. Multiplier effect: -5.3%.

Alternatively, if the pass-through is less than 100%. Suppose Canadian exporters absorb half the tariff by lowering their prices, so the US price increases by 12.5%. Then %ΔQ = ε * 12.5%. If ε = -1.2, then -15% quantity change. So -15% of $400 billion = -$60 billion, which is -2.86% of GDP. Multiplier 1.4 → -4% GDP.

This is still significant but more plausible. However, if exporters lower their prices, their profit margins decrease, which could affect domestic investment and wages, further impacting GDP. But maybe that's captured in the multiplier.

Other considerations:

- Exchange rates: If the Canadian dollar depreciates due to reduced demand for CAD (lower exports), Canadian goods become cheaper, offsetting some of the tariff effects. A 10% depreciation could make Canadian exports 10% cheaper in USD terms, countering the 25% tariff. For example, if the CAD depreciates by 20%, the effective price in USD would be (original price * 0.8) + 25% tariff = original price * 0.8 * 1.25 = original price. So the price in USD would remain the same, and quantity demanded wouldn't change. But this is a simplification. Exchange rates are determined by many factors, including capital flows, interest rates, etc. But including this in the model complicates things. Maybe assume a partial depreciation that offsets part of the tariff.

- Retaliation: If Canada imposes tariffs on US imports, this could hurt Canadian consumers and businesses that rely on US goods, leading to higher costs and lower consumption/investment. However, it might protect some domestic industries. The net effect is ambiguous but likely negative due to inefficiencies.

- Supply chain adjustments: Companies might try to circumvent tariffs by moving production, but that's a longer-term effect.

- Inflation: Tariffs could lead to higher prices in the US, reducing US consumers' purchasing power and possibly leading to lower overall demand for Canadian goods beyond the elasticity effect.

Given the complexity, maybe focus on the direct effect and multiplier, with a sensitivity analysis for elasticity and pass-through.

So, putting this into a model:

Variables:

- X0 = initial exports to US = $400B CAD

- t = tariff rate = 25%

- ε = price elasticity of demand = -1.2 (baseline)

- pass-through rate (ptr) = percentage of tariff passed to US consumers = 50%

- Effective price increase in US = t * ptr = 12.5%

- %ΔQ = ε * (t * ptr) = -1.2 * 12.5% = -15%

- ΔX = X0 * %ΔQ = 400B * (-15%) = -$60B

- GDP0 = $2100B CAD

- Direct impact on GDP = ΔX / GDP0 = -60 / 2100 ≈ -2.86%

- Multiplier (m) = 1.4

- Total GDP impact = -2.86% * 1.4 ≈ -4%

Sensitivity analysis:

- If ε = -0.8, ptr=50%:

%ΔQ = -0.8 * 12.5% = -10%

ΔX = -$40B

Direct impact: -1.9%

Total: -2.66%

- If ε = -1.2, ptr=100%:

%ΔQ = -30%

ΔX = -$120B

Direct impact: -5.7%

Total: -8%

- If ε = -0.5, ptr=50%:

%ΔQ = -6.25%

ΔX = -$25B

Direct impact: -1.2%

Total: -1.68%

Additionally, if we consider exchange rate depreciation, say CAD depreciates by 10%, making Canadian exports 10% cheaper in USD. The effective price in USD becomes (1 - 0.10) * (1 + t * ptr) = 0.9 * 1.125 = 1.0125, so a 1.25% increase instead of 12.5%. Then %ΔQ = ε * 1.25% = -1.2 * 1.25% = -1.5%, ΔX = -6B, impact much smaller. But modeling exchange rate changes requires a more complex model.

Alternatively, assume that the depreciation offsets part of the tariff. If CAD depreciates by x%, then the new USD price of Canadian exports is (1 - x%) * (1 + t). Set this equal to original price to negate the tariff:

(1 - x) * (1 + 0.25) = 1 → 1.25(1 - x) = 1 → 1 - x = 0.8 → x = 0.2, so 20% depreciation. Then US consumers pay the same price as before, so no quantity change. However, Canadian exporters receive (1 - 0.2) = 0.8 times the original USD price, which converted to CAD is 0.8 / (exchange rate). Wait, this is getting too complicated. Maybe better to note that exchange rate adjustments could mitigate the impact but require separate modeling.

In conclusion, the model would estimate a GDP decrease in the range of 1.2% to 8% depending on elasticity and pass-through assumptions, with a baseline around 4%. However, these are rough estimates and the actual impact would depend on multiple factors including policy responses, market adjustments, and global economic conditions.

1. Model Framework:

2. Assumptions:

Baseline Values:

Canadian exports to the US (X₀): $400 billion CAD

Canadian GDP (GDP₀): $2.1 trillion CAD

Tariff rate (t): 25%

Price elasticity of demand (ε): -1.2 (mid-range estimate)

Pass-through rate: 50% (half the tariff absorbed by exporters)

Multiplier (m): 1.4 (accounts for open economy effects)

3. Simulation Steps:

a. Calculate Effective Price Increase in the US:

b. Determine Export Quantity Change:

c. Compute Change in Export Value:

d. Direct Impact on GDP:

e. Apply Multiplier Effect:

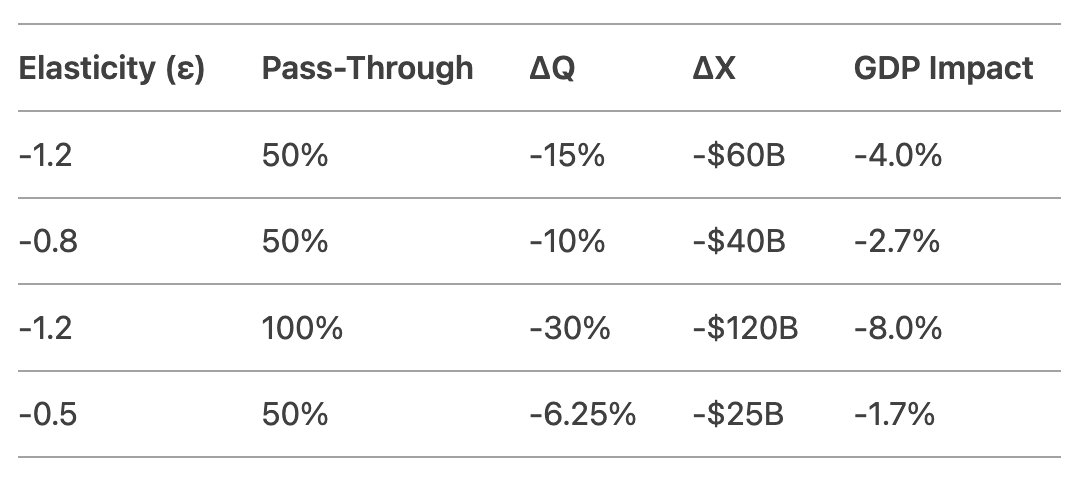

4. Sensitivity Analysis:

5. Secondary Effects:

Exchange Rates: A 20% CAD depreciation could offset tariffs, stabilizing export volumes but reducing revenue in CAD terms.

Retaliation: Canadian tariffs on US imports might harm domestic consumers and supply chains, exacerbating GDP loss.

Long-Term Adjustments: Firms may relocate production or renegotiate supply chains, mitigating long-term impacts.

6. Conclusion:

Baseline Scenario: A 25% US tariff reduces Canadian GDP by ~4.0%.

Range: Impacts vary from -1.7% to -8.0% depending on elasticity and pass-through.

Policy Implications: Tariffs would significantly harm Canada's economy, though exchange rate adjustments and trade diversification could soften the blow.

So there you have it. According to Deepseek, the tariffs could shave as "little" as 1.7% or as much as 8% off of Canada's GDP, with the baseline estimate around 4%. That's roughly in line with the Bank of Canada's projection. I wonder how long it took the staff at the BoC to come up with their figures. It took Deepseek about 12 seconds.

0 件のコメント:

コメントを投稿